How Inflation Affects Mortgage Rates

While you may be hoping that the Bank of Canada (BOC) would stop the rate hikes as the inflation targets are coming closer, looks like they will not stop soon, as it may help increase the inflation back again. Same was the case earlier this year in March and April, when the BOC decided to keep the overnight rate at 4.5% at two consecutive scheduled meetings, which fired back. Instant changes in spending habits were experienced, the real estate market was affected especially, as the demand increased due to influx of buyers and average purchase price went up again by 8-9%.

What is the effect of this on you?

Simply put, inflation and mortgage rates are directly proportional. That means when the inflation is high, so are the mortgage rates and vice-versa. Considering the inflation targets are met, lower mortgage rates will follow. This will make it easier for you to buy a house as you can afford more for the same monthly payment, this increases your affordability in general.

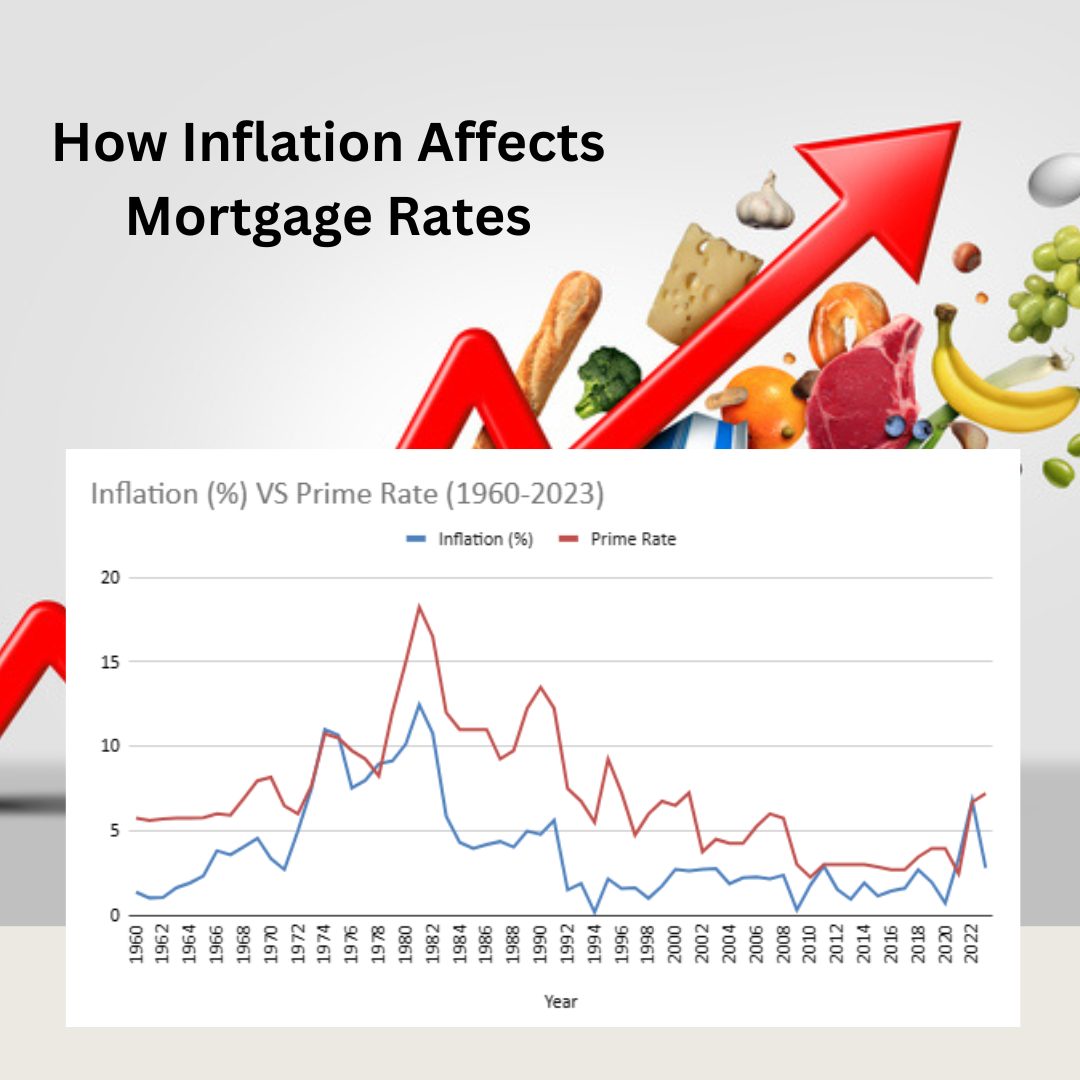

This graph shows the relationship between the inflation and the prime rates of lending from year 1960 to 2023, the said trend can be easily found throughout those years:

How Inflation Affects Mortgage Rates

As seen in the graph, inflation (shown in the blue) is following the downward trend and, based on historical trends, mortgage rates (shown in the red) are likely to follow.

Bottom Line

Inflation is staying stubbornly high. The economy has been remarkably good, the labor market is strong, but that contributes to high inflation. The only tool that the BOC has right now to control it is the overnight rate; looks like they will keep playing till they feel comfortable.

These adjustments always create some opportunities and you should be in good hands to capitalize on those. You can always count on me for expert advice on housing market changes and what they mean for you.

Bhupinder Singh

Realtor®️ Salesperson

Century 21

First Canadian Corp.

Phone: 647-323-5310

Email: getrealwithinder@gmail.com

Web: getrealwithinder.com

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link