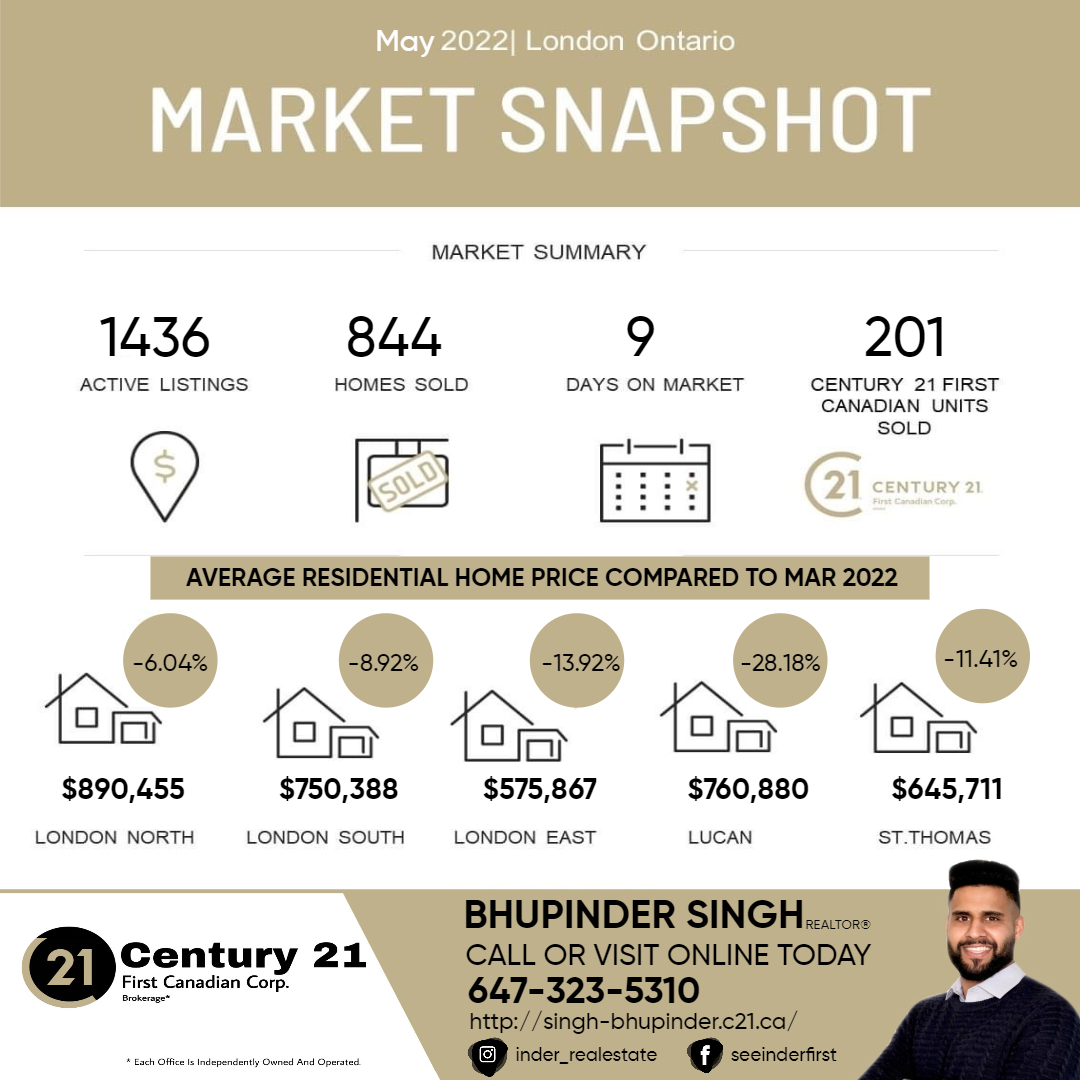

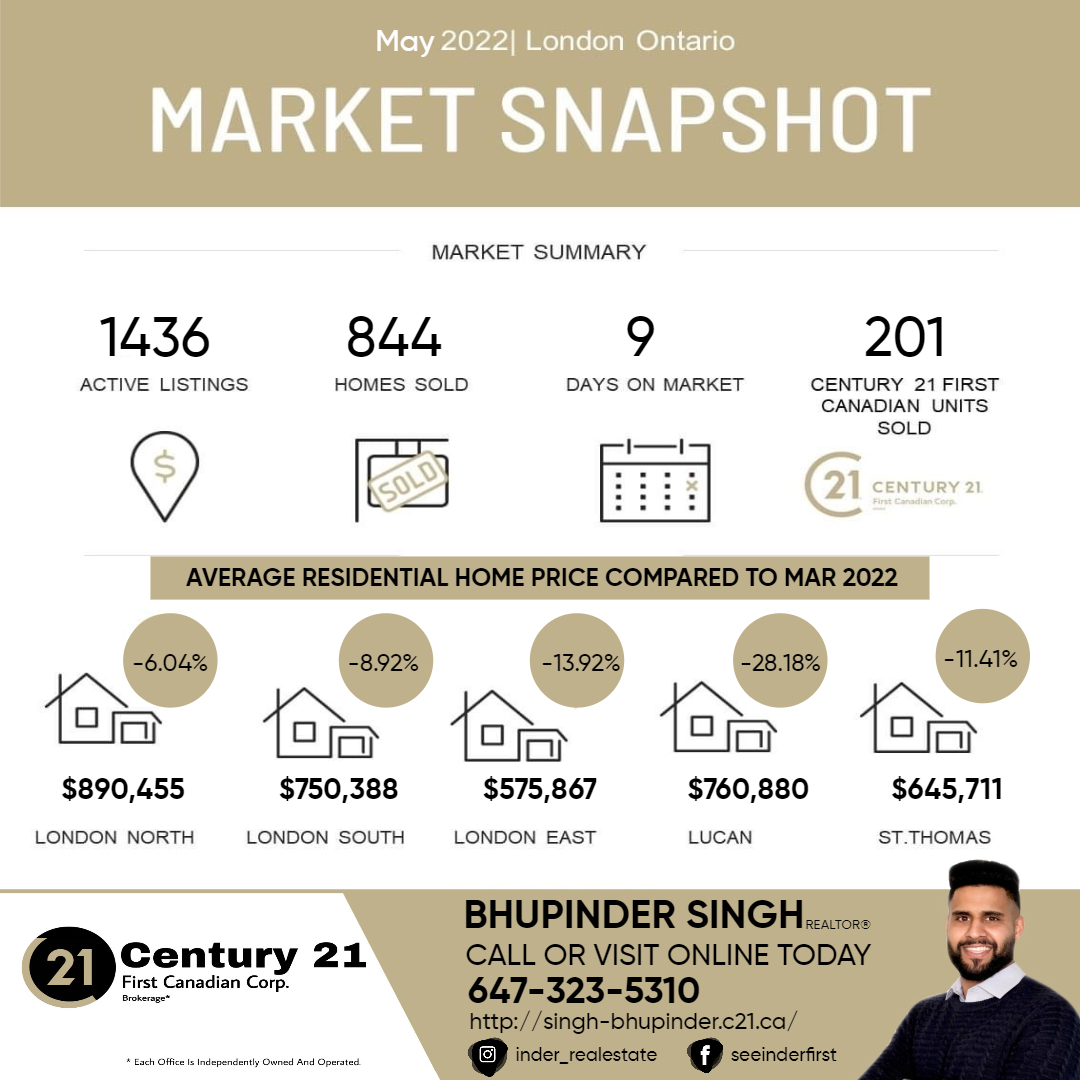

London’s housing continues to cool off past April and the trend of declining prices continues in the month of May. The average single family residential home price in London was $745,000 in May 2022, which is a approximately 11% lower compared to March’s average of $837,500 (according to Infosparks powered by itsorealesate.ca). This means that the average home in London, Ontario has decreased by $92,500 in a span of two months. The reported decline in home prices here is London (provided by LSTAR) aligns with the reports provided by other real estate associations in their respective areas, which shows an overall price decline in Ontario’s real estate market. The trend in St. Thomas and Lucan is the same, with 11.4% and 28.2% decline in average single family home prices.

Another interest rate hike was anticipated in the first week of June, which held back the buyers, as most buyers were expecting the prices to go lower going forward.

Is this the right time to buy, a firm “YES” for the people who were ready to buy even in February which saw the highest home prices in London. Also a “YES” for all others, as there is still less than 2 months inventory in the market making it a sellers market. Also, the bidding wars have become rare for most residential properties, which gives back some of the negotiating power back to the buyers.

Is this the right time to buy, a firm “YES” for the people who were ready to buy even in February which saw the highest home prices in London. Also a “YES” for all others, as there is still less than 2 months inventory in the market making it a sellers market. Also, the bidding wars have become rare for most residential properties, which gives back some of the negotiating power back to the buyers.

On the seller side, things have become more uncertain as there have been talks in the real estate community of some listings not getting any offers for weeks after going live, but not for sellers who list at the right price suggested by their Realtor. A large number of listings had the prices reduced to stay in lines with the competition and there have been many cases where appraisals came short for the properties that were sold in Feb-March and were due closing in May.

The overall trend shows a correction is happening, but more or less it has to do with the government strategies and media hype projecting a recession, as supply issues are still the same with low inventory. The number of sales remained almost the same, which shows there are still interested buyers out there and the sellers willing to accept the change are selling.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link