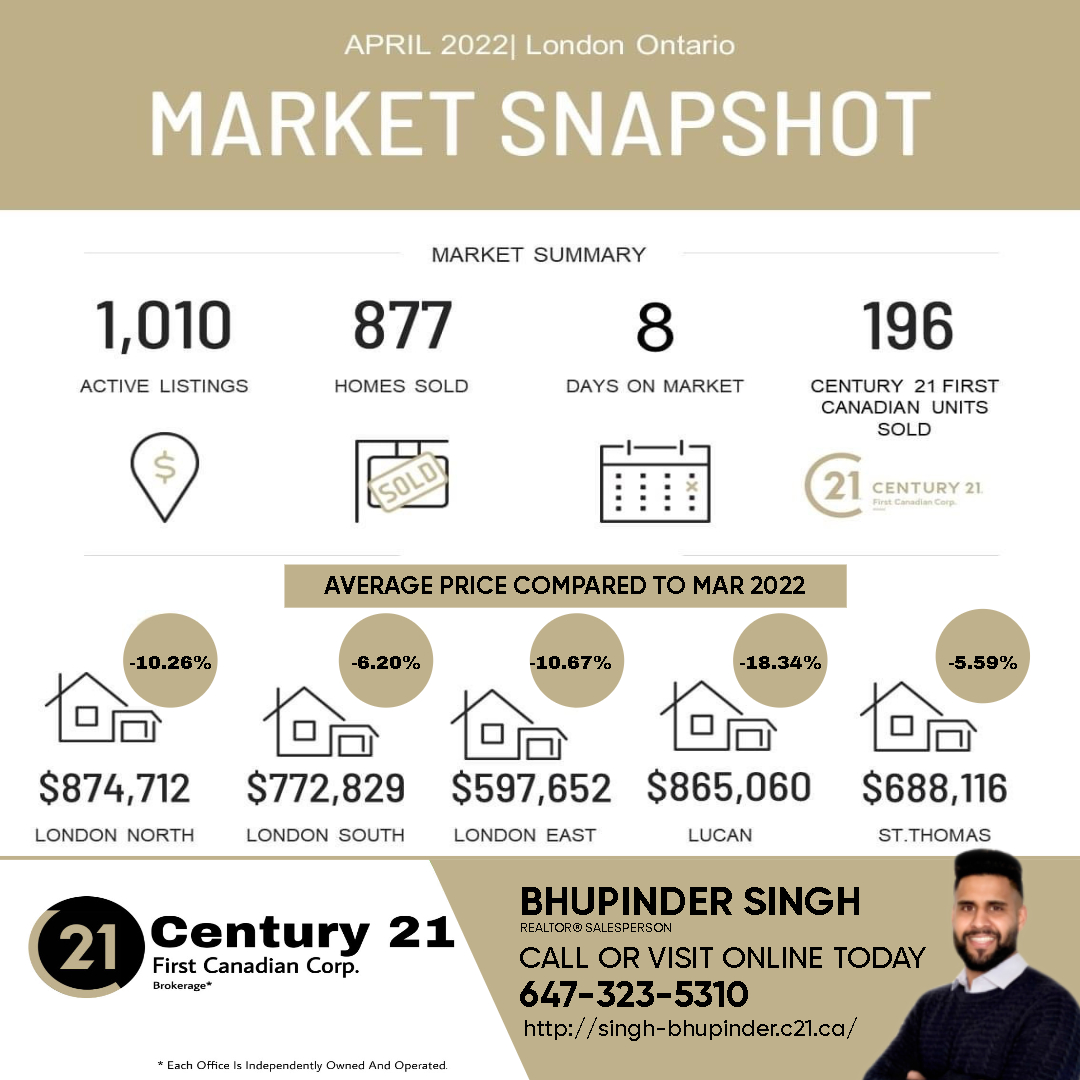

London’s housing has finally started to cool off in prices during the month of April 2022 after a constant increase in prices since Aug 2021. The average single family residential home price in London was $748,398 in April 2022, which is a approximately 9% lower compared to last month ($822,536). This means that the average home in London, Ontario has decreased by $74,139 in just one month. The reported decline in home prices here is London (provided by LSTAR) aligns with the reports provided by other real estate associations in their respective areas, which shows an overall price decline in Ontario real estate market. The trend in St. Thomas and Lucan is the same, with 5.55% and 18.3% decline in average single family home prices.

The interest rate hike seems to be the game-changer, which is certainly holding back the buyers as more rate hikes are anticipated from BOC in order to tackle the rising inflation. There are still questions on the proposed foreign investment ban, Will it be passed? What will be the date of the the proposed change? There definitely is a confusion regarding the matter, another factor adding to the declining prices to some extent.

The interest rate hike seems to be the game-changer, which is certainly holding back the buyers as more rate hikes are anticipated from BOC in order to tackle the rising inflation. There are still questions on the proposed foreign investment ban, Will it be passed? What will be the date of the the proposed change? There definitely is a confusion regarding the matter, another factor adding to the declining prices to some extent.

Good news for buyers is that for the first time since the October 2020, there is an inventory of more than 1000 houses at the month end in London. Is this the right time to buy, a firm “YES” for the people who were ready to buy even in February which saw the highest home prices in London. Also a “YES” for all others, as there is still less than 2 months inventory in the market making it a sellers market. Its really hard to predict if this downturn will continue, due to the supply issues and many other indicators signaling in the opposite direction. For many who are in a mood to wait and see what it brings, this might be an opportunity wasted.

On the seller’s side, there is a mixed reaction, many sellers are still not able to digest the fact that they have to settle with considerably lower price for their house compared to earlier months. Advise for them, do not over price your property as it will bring bad reputation for the property. Buyers and brokers will be hesitant to see the house and there is a greater chance of it being an example property, which is on market for longer than normal due to higher price.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link