What Is Trigger Rate And When It Comes Into Play?

WHAT IS TRIGGER RATE?

If you are in a variable rate mortgage and not an adjustable one, then you must pay close attention to this post.

First let us differentiate between variable and adjustable rate mortgage. “Adjustable Rate Mortgage” is the one where your payment increases as the interest rates go up (with recent hikes in overnight rates by bank of Canada to tackle inflation). Whereas, in a “Variable Rate Mortgage” your mortgage payment does not change, i.e. it stays static, does not matter if the interest rate goes up (that actually is not the case if the rates go really high, huge increases in interest rates is when trigger rate comes into play).

With every increase in the interest rates, people with variable rate mortgages are paying more interest and less principal. With more rate hikes going forward, there will be a time when your mortgage payment will be interest only and no principal at all. And if that interest rate only part exceeds your monthly payment at some point of time, then your amortization will be infinity, and you will be hit with the trigger rate.

This raises a question that how will that be applied? There could be an additional payment that you will pay monthly along with your existing mortgage payment or a lump sum payment, it is for your lender to decide.

As a general rule of thumb, prime normally has to rise 2% or more before you get hit by trigger rate.

So, plan ahead and be ready for the change.

Contact me for more info:

📞 (647) 323-5310

📧 bhupinder.singh2@century21.ca

If you’re thinking of SELLING, BUYING, BUILDING, or INVESTING in London or the surrounding area, contact me.

Bhupinder Singh

Realtor® Salesperson

“Client Focused, Results Oriented”

Century 21 First Canadian Corp.

Reasons Why You Must Consider Hiring A Real Estate Agent Over “For Sale By Owner”

When you think of selling your home by yourself, you may think that this would save you a lot of money. After all, the standard real estate agent’s commission is 3% to 4% — that’s $15,000 to $20,000 on a $500,000 home.

Given the magnitude of this fee, you might think that acting as your own seller’s agent is certainly worth the savings. Here are some reasons why you might want to reconsider, you can also use this as a guide to improve on the common mistakes made by FSBO sellers:

Biggest Reason:

90% of real estate transactions involve a real estate professional, which means that 9 out 10 times you will be approached by a Realtor enquiring about your property. They will expect you to pay buyer side’s commission of 2% and in most cases you will say yes. Also, the left over 10% are not the private buyers only, it consists of a huge chunk of new construction home sales which are done using sales managers (approximately 4%). Considering that, you will mostly likely be working with a real estate professionals who is protecting best interests of buyer client not yours, but you are paying his commission. I hope that makes sense, now lets take a look at all the reasons below that will show why its worth paying another 1.5-2% to the listing agent who is protecting your best interests and will take all the load off your shoulders.

Emotional Sales:

Selling your home can be an emotionally challenging process. Having an agent helps you stay in control and avoid making any mistakes , such as overpricing the price of your home, refusing to counter a low-ball offer because you’re offended, or simply giving up when your sales deadline expires. If you abandon the agent, you will have to deal directly with the denial each time the buyer’s agent says that they are not interested in the property anymore.

FSBO Is A Full Time Job:

Can you frequently miss work to accommodate showing requests to see your home? Can you leave a meeting every time your phone rings? Do you have the energy to market the property at every opportunity? What experience do you have with selling houses? Do you have experience doing this? Your answer to all of these questions is probably “no”. The agent answered “yes” to all of these questions. Also, with an agent, you get a lockbox for your front door, and the they can show your home even when you’re not there. Anybody who visits your house has their identification verified by their agents. They also organize open houses to generate more footfall and every visitor signs a sign-in sheet before entering.

FSBO vs Realtor Stats:

FSBO accounted for 7% of home sales in 2020. A typical FSBO home sold for $ 260,000, compared to $ 318,000 for agent-assisted home sales. Source: 2021 National Association of REALTORS® Profile of Home Buyers and Sellers. Hiring an agent means they correctly value your property and get you the most money in the shortest amount of time, a combination that means 10-23% more net profit. If you are considering saving 2-4% on listing fees, keep this in mind.

You Have To Advertise To Agents Not Buyers, So You Must List It On MLS:

Approximately 90% of homes that are sold are listed with real estate agents, which means all those sales utilize a buyer agent. Considering this fact, you must really be advertising to buyer agents, not buyers. Just listing your property on MLS make your property accessible to all these buyers and their agents. Just listing on MLS with low commission brokerages will again not be a good step, as they normally are not available to promptly answer all the queries and sometimes even work remotely; there are a lot of other disadvantages of using them compared to an agent who works full-time for you. Local agents have big networks within and outside of their brokerages, with large distribution lists which they use to send email blasts for their new listings.

Approved Buyers:

Realtors can find out if the person who wants to see your home is really a qualified buyer, a dreamer or a nosy neighbor. Its a lot of work and a big interruption, every time you need to put your life on hold, to prepare and show your home. These issues should be limited by the screenings to the showings that will most likely lead into a sale. Also, most buyer agents make sure that they are working with buyers who are pre-approved to buy the house and know the price range they can buy within, so there is a good chance that the buyer who walks in your house is financially capable to afford it.

Price Negotiation:

Even with other sales experience, you have no experience in negotiating home sales. As the buyer’s agent does this, they are more likely to succeed in the negotiation. In other words, you have less money in your pocket. It’s also likely to be emotional about the process, and if your agent doesn’t point out when it’s unreasonable, you’re more likely to make a bad decision.

Ignorance:

A real estate agent can guide you through your home and point out the changes you need to make to attract buyers and get the best deal. They can see problems that you don’t notice because you see them every day, or just because you didn’t see them one. They can also help you determine feedback from potential buyers and act on it after you bring your home to market, in order to increase your sales potential.

Legalities:

Selling a home requires many legal forms and paperwork that professionals need to fill out correctly. One of the most important points is the information provided by the seller. Sellers may be liable for fraud, negligence, or breach of contract if material defects they know about the property are not fully disclosed. Unless you’re a lawyer, your agent probably knows more about disclosure laws than you do. The buyer can sue you if you do not disclose any danger, obstruction, or flaw, and if the buyer returns to you after they move and discover the problem. Agents can also make mistakes, but they are covered by errors and omissions insurance. So the buyers will claim damages from realtors in case they made a mistake, as they have professional liability insurance to protect themselves and provide buyers with reimbursement claims.

Showings:

Its almost always impossible for a buyer to freely explore the house when the seller is present, it makes them uncomfortable. Having a property listed on MLS will bring the buyers who are accompanied by their agents, which is our primary market audience as discussed above, gives the buyer space to speak openly about the property with no worries of hurting seller’s feelings.

Your Property Might Not Be Shown To Interested buyers:

In FSBO transactions, the buyer’s agent knows that there are no experts at the other end of the transaction. Even if the buyer insists on looking at your home, the agent will point out the difficulties and risks involved when the seller tries to market the transaction without a professional agent and without a guaranteed commission. Even if they bring in their buyers, you will still end up paying commission for the buyer’s agent.

Scams:

FSBO scams occur on both sides of a real estate transaction with very little recourse. Common scams include fraudulent appraisals & loan paperwork, foreign buyer deposits, purchases through a fake lawyer, and asking for personal information.

Services Provided By Realtors That You Will Miss Out On:

- Full Time availability

- Dealing with buyer enquiries

- Negotiations

- Secure showings with lockboxes

- Open houses

- Expert Advice

- Home Staging Assistance

- Realistic pricing strategy

- Comparative market analysis

- Knowledge of current market trends

- Trusted third party contractors

- Marketing strategies

- Analysis of the property

- Professional photography provided for no charge by most realtors

- And much moreContact me for more info:📞 (647) 323-5310

📧 bhupinder.singh2@century21.caIf you’re thinking of SELLING, BUYING, BUILDING, or INVESTING in London or the surrounding area, 📲 call me @ 647.323.5310!

Bhupinder Singh

Realtor® Salesperson

“Client Focused, Results Oriented”

Century 21 First Canadian Corp.

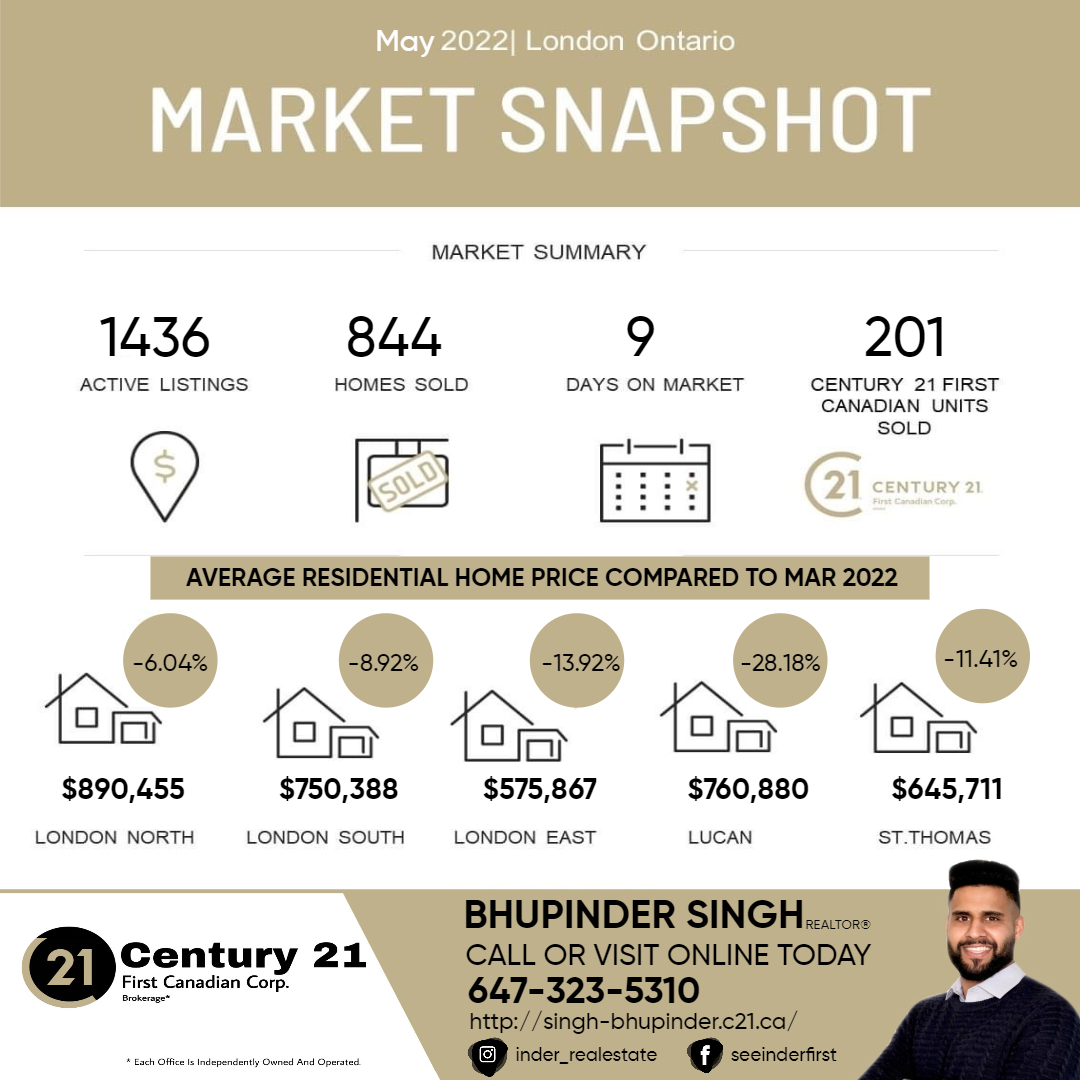

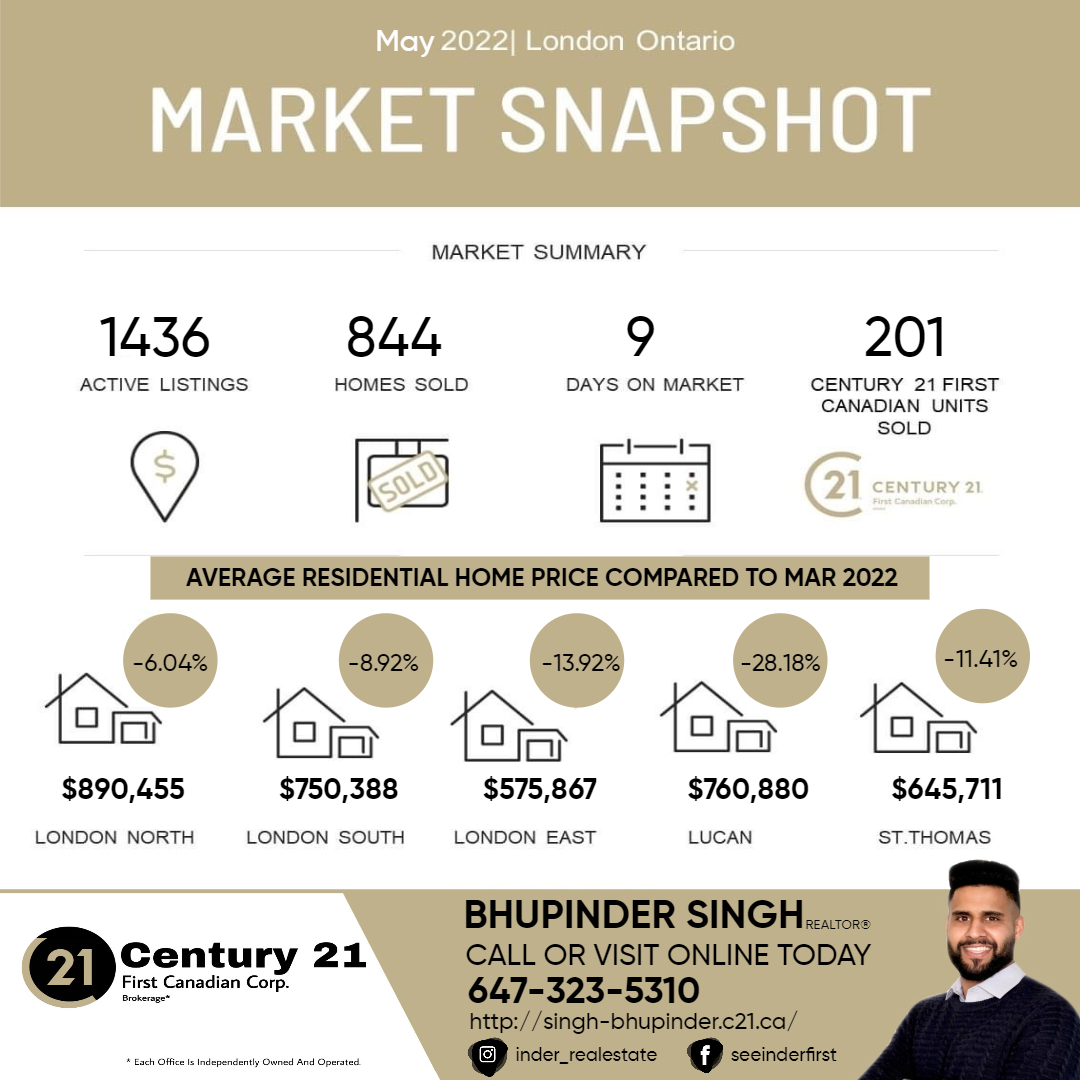

London Ontario Market Report May 2022

London’s housing continues to cool off past April and the trend of declining prices continues in the month of May. The average single family residential home price in London was $745,000 in May 2022, which is a approximately 11% lower compared to March’s average of $837,500 (according to Infosparks powered by itsorealesate.ca). This means that the average home in London, Ontario has decreased by $92,500 in a span of two months. The reported decline in home prices here is London (provided by LSTAR) aligns with the reports provided by other real estate associations in their respective areas, which shows an overall price decline in Ontario’s real estate market. The trend in St. Thomas and Lucan is the same, with 11.4% and 28.2% decline in average single family home prices.

Another interest rate hike was anticipated in the first week of June, which held back the buyers, as most buyers were expecting the prices to go lower going forward.

Is this the right time to buy, a firm “YES” for the people who were ready to buy even in February which saw the highest home prices in London. Also a “YES” for all others, as there is still less than 2 months inventory in the market making it a sellers market. Also, the bidding wars have become rare for most residential properties, which gives back some of the negotiating power back to the buyers.

Is this the right time to buy, a firm “YES” for the people who were ready to buy even in February which saw the highest home prices in London. Also a “YES” for all others, as there is still less than 2 months inventory in the market making it a sellers market. Also, the bidding wars have become rare for most residential properties, which gives back some of the negotiating power back to the buyers.

On the seller side, things have become more uncertain as there have been talks in the real estate community of some listings not getting any offers for weeks after going live, but not for sellers who list at the right price suggested by their Realtor. A large number of listings had the prices reduced to stay in lines with the competition and there have been many cases where appraisals came short for the properties that were sold in Feb-March and were due closing in May.

The overall trend shows a correction is happening, but more or less it has to do with the government strategies and media hype projecting a recession, as supply issues are still the same with low inventory. The number of sales remained almost the same, which shows there are still interested buyers out there and the sellers willing to accept the change are selling.

What is a mortgage and the process of finding the perfect mortgage for yourself

There's a good chance already know the basic concept of getting a loan to become a homeowner. But in reality, mortgages are fairly complex, as it includes financial calculations, offer comparisons, and various levels of approval.

In this article, you'll find out more about mortgages in simple, easy-to-understand language. I will guide you through the mortgage process from start to finish.

What is a mortgage?

A mortgage is a loan that you can use to buy real estate, which acts as collateral for your loan. Mortgages are usually large and usually repaid in 25 or 30 years. When you take out a mortgage, you agree to make regular payments. Payments for these mortgages consist of principal and interest. When the payment is made, the interest is covered first and then the principal. Mortgages allow mortgage lenders to own property if you do not make the agreed payments on time.

allow mortgage lenders to own property if you do not make the agreed payments on time.

Mortgage Process

If you decide to buy a house, the next step is to figure out how to pay for it. Unfortunately, most of us don't have the money saved to buy a full home. That's where mortgages come in. Before looking for a property, it's a good idea to get a mortgage pre-approval. If you are pre-approved, you will know exactly how much you can afford for your home. You can also mitigate the risk because you are much less likely to make an offer to a home that you can't afford.

Once you receive the pre-approval, you can buy the house. It is useful to create a list of needs and wants. That way, you can see each house objectively when deciding if it suits you.

If you find a house you like, make an offer. Once your offer is accepted, work with your banker or mortgage broker to get your final mortgage approval. Documents and information must be provided at this step. The lender will then sign off and provide a Mortgage commitment, and you can remove the loan terms from your offer.

How do you know it's time? (Click here to visit my Instagram post on how to do calculations to see if you are ready to afford a house)

When is a good time to buy a house and get a mortgage? A good time is when you are personally and financially ready. This means that you have a stable job, establish yourself in your personal life, and are committed to staying in the same place for the next 5 or 10 years.

When applying for a mortgage, the lender wants to make sure you can afford it every month. The lender does this using two leverage ratios. Gross Debt Service ratio and Total Debt Service ratio.

The GDS ratio indicates the percentage of total monthly income required to cover housing-related costs (mortgage payments, property taxes, heating and maintenance costs (if applicable)). Most lenders are aiming for a GDS ratio of less than 39%. The

TDS ratio is similar to the GDS ratio. It looks the same as the GDS ratio, but takes into account any other debt you may have. It is B. Credit Card Debt or Credit Line. Normally, 3% of the outstanding balance is used for debt repayment purposes. For fixed installment loans (car loans, car leases, personal loans, etc.), the payment is used to repay the debt. Most lenders are aiming for a TDS ratio of less than 44%.

Please note that the mortgage payments used in these calculations are higher than you actually pay. This is because payments are calculated at an inflated stress test rate which is currently higher of 5.25% or the interest rate plus 2%.

Where can I get a mortgage?

There are several ways you can take when looking for a mortgage, such as going to a bank or credit union or working with a mortgage broker.

Banks

When looking for a mortgage, your instinct is probably to go to the branch of your local bank where you have a checking account. Banks offer a variety of products, and it's helpful to have all your important financial information in one place. Some banks also offer additional benefits when you bundle your mortgage with another product.

However, simply borrowing a mortgage from an existing bank that you use for checks and savings may miss the more competitive interest rates offered elsewhere. The mortgage market is very dynamic and shopping is always a good idea.

Mortgage Broker

Another way to look around is through a mortgage broker. Independent mortgage brokers have access to dozens of lenders and can provide fair advice. Even if you end up going to a branch of a local bank, at least you have the peace of mind that you've got a good deal.

Important terms

Pre-qualification

This is ideal if you are just thinking about buying a home. The lender collects basic information about your finances and then gives you an approximate number of amounts that they may lend to you to buy real estate.

Pre-approval

Pre-approval of a mortgage is more formal than pre-qualification screening. At this stage, the lender will review the financial information you have provided and perform a credit check. If you are pre-approved, that means the lender has promised you a loan, but the final amount they will lend to you and the terms of the mortgage are in fact real estate appraisals and market volatility.

Mortgage Stress Test

This is a calculation of whether you can afford a mortgage even if interest rates rise. The results of this stress test determine the eligibility of the mortgage you want to take home and apply to all homebuyers, including those who are paying a 20% down payment at their home. The benchmark rate for qualifying under stress test is greater of either 5.25% or the interest rate plus 2%. This means if you are offered 2.99% by the lender, then your qualifying rate is 5.25%; but if you are offered 3.79% interest rate by the lender, then the qualifying rate will be 5.79%.

Deposit

This is the amount that must be paid in advance when purchasing a property. The more down payment you have, the less mortgage you will need. The amount of your down payment depends on the purchase price of your home. For example, if you spend less than $500,000 at home, you only need to put down 5% of the purchase price.

Mortgage Interest Rate

This is the interest you pay for your mortgage. This determines the interest you pay over the entire term of your mortgage. The interest rate on your mortgage can vary depending on whether it is fixed or variable.

Closing Costs

Examples of closing costs include real estate attorney fees, real estate transfer taxes, housing inspections, appraisal fee and moving costs. It is advisable to budget for closure costs between 1.5% and 4% of the home purchase price.

Different types of mortgages

Insured

For insured, you need to pay the default mortgage insurance to protect the lender. For this reason, most lenders offer the lowest mortgage rates on these products.

Insurable

Insured or traditional mortgages are for paying a down payment of 20% or more at home. In this case, you do not need to take out mortgage insurance. In this case the mortgage is insured by the lender instead of the borrower. Lender pays the insurance premium and insures your mortgage.

Uninsurable

An uninsured mortgage is a mortgage that does not meet the government guidelines for any of mortgage insurance companies to insure. Examples include buying a home over $1 million and amortization of more than 30 years of investment. For this reason, uninsured mortgages tend to have the highest mortgage rates .

Term and Amortization

The mortgage term is the period during which the terms of the mortgage are guaranteed. When you have a fixed rate mortgage, the interest rate on your mortgage will remain the same over time.

Mortgage amortization is the time it takes to fully pay off your mortgage. Canada's standard period is 25 years and nothing prevents short-term or long-term choices as long as you pass the stress test.

Open or Close Mortgage

With an open mortgage, you can repay your mortgage in full at any time during the period. For this reason, mortgage rates tend to be higher. Open mortgages only make sense if you expect a huge cash windfall or intend to sell your home in the near future.

A closed mortgage has limitations on how much extra money you can put towards your mortgage beyond your regular mortgage payments. Because of that it comes with a lower mortgage rate than an open mortgage.

Fixed or Variable Mortgage

With a fixed rate mortgage, your mortgage rate and payment amount remains the same during your mortgage term. With floating rate mortgages, mortgage rates and payments can change over the life of the mortgage based on changes in the lender's base interest rate. These mortgages usually have higher mortgage rates than variable rate mortgages. This is for stability because we know exactly the mortgage interest rate and payment.

What do lenders look for when approving a mortgage?

Lenders consider several factors when deciding whether to approve a mortgage application. You look at your income, down payment, assets, liabilities, credit, and the property itself.

Income

Lenders look for borrowers with a stable source of income. You must be able to prove that you have enough income to pay your mortgage payments on a regular basis. If you are a full-time and hourly wage employee, you will spot the eyes of most lenders. If you are a full-time or part-time worker with unguaranteed time, or if you work on a contract basis, it usually takes average of two income years for the lender to consider your income. For proof of income, you`ll usually need to provide a letter of employment, recent paystub, T4s, and notices of assessment for the last two years.

If you`re self employed usually you can still get a mortgage, however you`ll need to provide more documentation. The income from your own business is less stable than a fulltime salaried position in the eyes of lenders, you`ll need to be in business for a minimum of two years and provide Personal T1 Generals, Notices of Assessment and Corporate Financial Statements for the two most recent years.

Down payment

Usually, if the deposit is from a bank account, the lender wants to see the transaction history for 90 days. If the funds are from an investment or RRSP, you will usually need to submit a three-month statement. If the sale is for another property, you will usually need to provide a copy of the signed agreement of purchase and sale; and a recent mortgage statement if the property you sold has a mortgage. When you receive gift money, the lender usually asks for a signed gift letter and confirms evidence that the money has been transferred to your bank account.

Assets

You need to provide the lender with an overview of your assets such as checking accounts, savings accounts, TFSA, RRSP, unregistered accounts, vehicles, etc. Assets are not considered in the calculation of the leverage ratio, but important assets prove to the lender that you are a responsible borrower. Imagine someone making $200,000 a year for 10 years, but having no assets at all. It will raise a red flag with the lender. Did the borrower use all the monies he earned?

Debt and credit

Debt and credit are linked. The lender looks at the type of credit you have, the outstanding balance and payment status, your credit score and credit history when assessing you as a borrower. This information is included in the borrower's credit report and the lender must obtain written approval for access.

Lenders usually look for borrowers with a credit score above 670 or 680 without payment delays or overdue. However, you may still be able to get a mortgage if you are overdue, or in some cases bankruptcy or filing a consumer declaration. Lenders will usually want to know why you have a credit error. If this is due to your uncontrolled living environment (for example, you got sick or were dismissed from work and are late for your invoice), otherwise prove you are a responsible borrower.

Property

The last thing the lender considers is the real estate itself. This is done through an appraisal. Depending on the property and its location, some lenders may use an automated valuation model (AVM) to determine the value of the property. Other lenders may require a full valuation and need the appraiser to visit the property for the evaluation. A real estate appraisal confirms that the real estate is worth the amount you paid. It also notifies the lender of the condition of the property.

Things to consider when getting a mortgage

Tip: Mortgage rates should not be the only factor that you consider when applying for a mortgage. Below are some situations why:

Do you want to cancel your mortgage?

When you take out a mortgage, you probably won't think of breaking it. However, many things can happen during a typical five-year mortgage term. If you think you need to cancel your mortgage during the period, we recommend choosing a lender and mortgage type with a low mortgage penalty. Variable rate mortgages usually have lower penalties than fixed rate mortgages.

How will I be punished if I break my mortgage?

If you are breaking your mortgage during the mortgage period to buy a new home, you may be able to avoid mortgage penalties by transferring your mortgage. Porting your mortgage means you bring you and your mortgage to a new property. Some lenders have a more flexible portability policy than others. One lender may give you only 30 days to port your mortgage, while another lender gives you 90 days. If this is important that you ask the lender for more information on their portability policy.

How about prepayment?

If you want to proactively repay your mortgage, you need to pay in advance. Prepaid payments are usually made in three forms: regular increments, doublings, and lump sum payments. Not all lenders offer the same prepayments. For example, one lender might only let you make 10% lumpsum payments and increase your mortgage payment by 10% per year, while another may let you make 15% lumpsum payments and increase your payment by 15% per year. By choosing the lender with the right prepayments for you, you can pay down your mortgage at the pace you want without incurring a penalty for making too many extra payments.

Last word

As you can see, there are a lot more things to consider when shopping for a mortgage than just the mortgage rate.

The mortgage process can be stressful, but it doesn`t have to be. After reading this article, the next time you apply for a mortgage, you should be better prepared. Knowing exactly what the mortgage lender is looking at, where to look, and what they expect will make the process much smoother.

Contact me for more info:

If you’re thinking of SELLING, BUYING, BUILDING, or INVESTING in London or the surrounding areas,

Bhupinder Singh

Realtor® Salesperson

"Client Focused, Results Oriented"

Century 21 First Canadian Corp.

Best Elementary Public Schools In London Ontario; Ratings, Rankings and Boundaries- TVDSB (Thames Valley District School Board)

London has some of the top schools in the province and finding a good school area is now easy with the new technology and school locators, please find more information about those tools below.

Rankings are provided by Fraser Institute and the boundary search can be done using the tool developed by Thames Valley District School Board.

The Fraser Institute is an independent, non-partisan research and educational organization based in Canada. For more information, please use Find My School Tool by Fraser Institute and the the Fraser Institute Rank Reports.

Click here to get directed to the TVDSB School Locator Tool. This tool can also be used to locate boundaries of all

the public schools in the city. TVDSB tries to keep attendance areas up to date, but their accuracy can’t be guaranteed. If you have questions about the school for your area, call us at 519-452-2000.

Here is a list of all the elementary schools in London, Ontario with their scores and provincial-ranks.

Contact me for more info:

📞 (647) 323-5310

📧 bhupinder.singh2@century21.ca

If you’re thinking of SELLING, BUYING, BUILDING, or INVESTING in London or the surrounding area, 📲 call me @ 647.323.5310!

Bhupinder Singh Realtor® Salesperson

“Client Focused, Results Oriented”

Century 21 First Canadian Corp

Sources:

Fraser Institute: https://www.fraserinstitute.org/school-performance

TVDSB: https://www.tvdsb.ca/en/schools/find-my-local-school.aspx?_mid_=332

London Ontario School Search and Boundary Maps

Your home address determines your school attendance, every school has its own set of boundaries. This is also known as a zone, catchment area or attendance area. Boundary studies or accommodation reviews are used to create and adjust school boundaries.

There are two major school boards in London:

1. Thames Valley District School Board- TVDSB

2. London District Catholic School Board (Roman Catholic)- LDCSB

Both boards have set up school locators that can help you determine which school district you live in and whether you are eligible to ride the bus to school. Please make sure you choose the correct school year when determining eligibility because boundaries can change from year to year.

Please follow these links to find your school for both boards respectively:

TVDSB- https://www.tvdsb.ca/en/schools/find-my-local-school.aspx

LDCSB- https://www.ldcsb.ca/apps/pages/index.jsp?uREC_ID=1076461&type=d&pREC_ID=1360078

If you are looking to buy or sell, call or DM me. I will be glad to help!

Bhupinder Singh

Realtor®️ Salesperson

Century 21

First Canadian Corp.

Phone: 647-323-5310

Email: bhupinder.singh2@century21.ca

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link